Nearshoring: priorities for regional development

- Nuevo León, Aguascalientes and Coahuila have favorable conditions to attract investment related to nearshoring. They have more skilled labor, better working conditions and better infrastructure. However, access to water as a basic input is a challenge.

- Oaxaca, the State of Mexico and Zacatecas present challenges in attracting investment due to the lack of skilled labor, poor public transportation and insufficient wastewater treatment infrastructure.

In recent years, the nearshoring phenomenon has been identified as an important opportunity to increase the attraction of investments focused on boosting industry. However, in order to take advantage of this opportunity, the different regions of the country face some structural challenges in several key areas.

Since 2023, the Mexican Institute for Competitiveness (IMCO) and the Friedrich Naumann Foundation (FNF) have analyzed different indicators identified as priorities by authorities, investors and potential investors in Mexico. Based on these considerations, IMCO determined 21 variables related to the labor market, basic inputs, housing and the regulatory environment in the states.

The second edition of this exercise presents an updated version of the situation of the Mexican states in terms of competitiveness and preparedness for the opportunities generated by nearshoring.

The research shows that Nuevo León, Aguascalientes and Coahuila perform better than the rest of the states in the four areas analyzed and have the facilities to take advantage of the trend of relocating production chains. In contrast, Oaxaca, the State of Mexico and Zacatecas are states whose structural conditions make it difficult to attract investment and increase economic activities linked to nearshoring.

Results by evaluated axis:

Labor market

Characteristics related to factors such as labor availability, educational level and infrastructure, and access to job training and skills such as English proficiency are analyzed. These characteristics may be attractive to companies and workers interested in taking advantage of the benefits of competitive labor markets.

In this factor, the results show a greater potential to add more people to the labor market in states such as Guanajuato, Tlaxcala, Sinaloa and Durango. In Baja California Sur and Jalisco, on the other hand, the labor market shows a lower number of people available and willing to join the employed population.

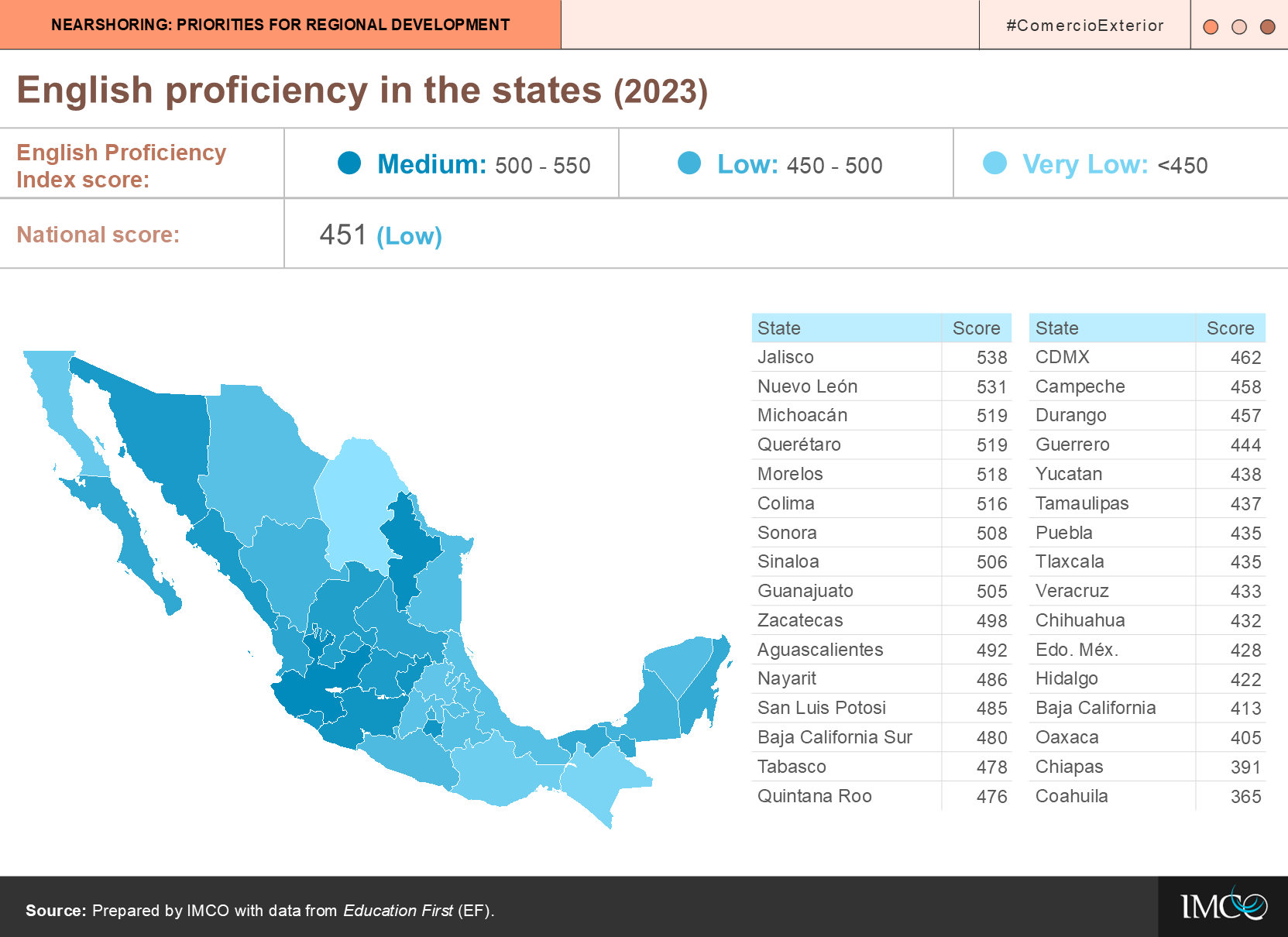

Additionally, English proficiency -an attractive element for investors and transnational companies that may come to the country- is highest in Jalisco, Nuevo León and Michoacán, while Coahuila, Chiapas and Oaxaca have the lowest skill levels in the country.

Housing and basic services

The indicators related to this factor take into account the availability of housing in the states and access to basic services in homes, as well as the number of public transportation vehicles that allow workers to connect with their places of employment.

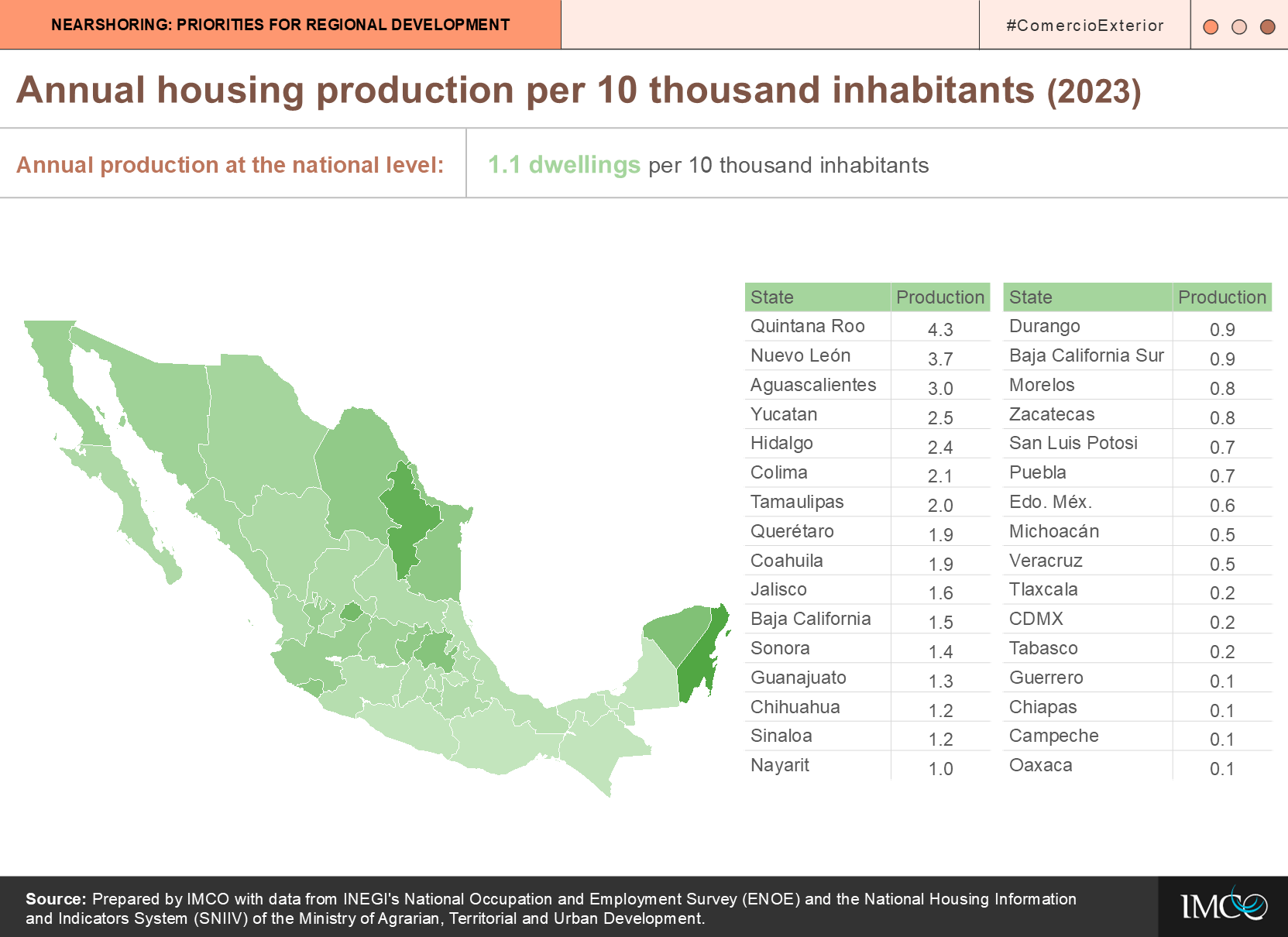

Annual housing production shows the increase in available space for new workers and their families and reflects the adequacy of a state's housing infrastructure. Quintana Roo, Nuevo Leon and Aguascalientes had the highest housing production per inhabitant in 2023, while Guerrero, Chiapas, Campeche and Oaxaca reported the lowest levels.

In terms of public transportation, there is a disparity in access to passenger transportation units between Mexico City and the rest of the country. While in Mexico City there are almost 3,000 passenger transportation units per million inhabitants, in the remaining states the availability is between 126 and 767 units per million people. Chihuahua, Zacatecas and Colima have less than 160 passenger vehicles per million inhabitants.

Infrastructure

The availability of basic inputs was considered, i.e., access to electricity and water at affordable prices and with a constant supply. In addition to the marginal prices of electricity and the availability of renewable water, the sufficiency of the water infrastructure of the states is analyzed.

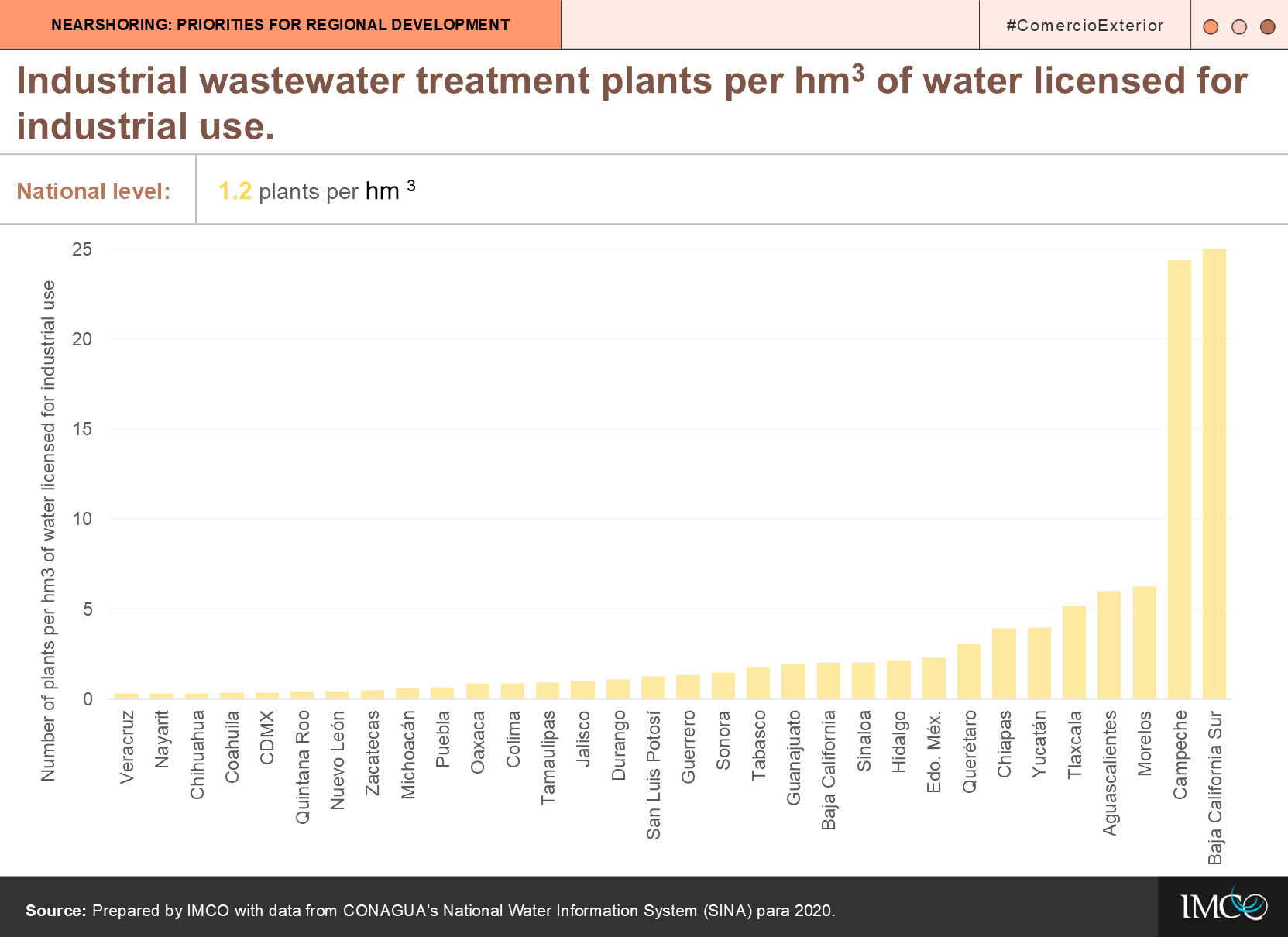

The number of plants dedicated to treating industrial wastewater relative to the amount of water licensed for industrial use in a region reflects the sufficiency of the infrastructure to reuse water resources and ensure their sustainable supply. Campeche and Baja California Sur had the best performance in this area, while Veracruz, Nayarit, Chihuahua, Coahuila and CDMX showed insufficiency.

In addition, the supply of reliable and competitively priced electricity is one of the guarantees that companies must have. Electricity is obtained at more affordable prices in some northern states, particularly Baja California, Sonora, Sinaloa and Chihuahua. In contrast, Baja California Sur and Quintana Roo have the highest electricity costs.

Rule of law and regulatory framework

Finally, indicators of crime incidence in companies, perception of the efficiency of the entity's regulatory framework and the existence of government programs aimed at attracting investment were considered.

The variable related to government programs -which can give a boost to companies and increase competitiveness- was most prevalent in Sinaloa and Yucatán; in Hidalgo and Morelos few companies identified any such program.

This diagnosis is a starting point for outlining a tailor-made work route that addresses the priority pending issues for each entity and generates the necessary conditions to promote regional development in the country.

Consult the full document here.