Tariffs 101: What Are They, Who Foots the Bill, and Who Wins (if anyone)?

By Diego Marroquín Bitar and Valeria Moy

What Are Tariffs?

Tariffs are taxes that governments impose on trade. While they can apply to exports, they are primarily levied on imports, typically to protect local industries. Imagine a local market selling apples. The retailer can choose between locally grown apples and imported ones. If a foreign producer wants to sell apples in this market, they might find their goods subject to a tax a tariff making imported apples more expensive than domestic ones.

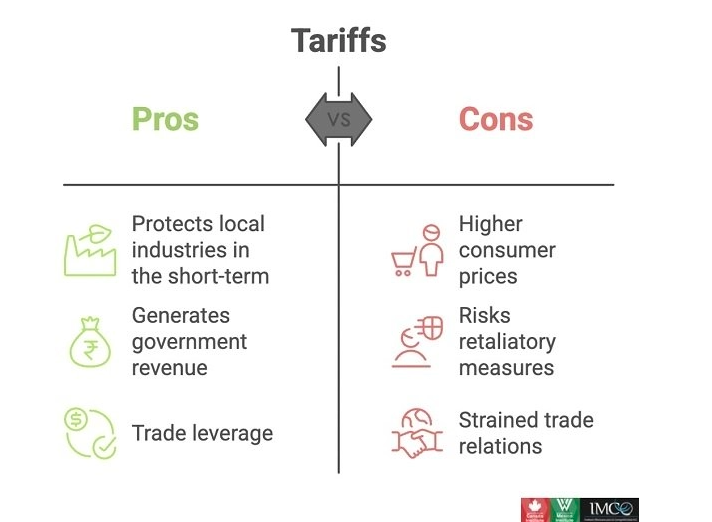

The rationale behind tariffs is straightforward:

- By making imports more expensive, tariffs make local goods comparatively cheaper and, at least in the short run, more competitive.

- Like other taxes, tariffs provide income that can be used to support local industries, fund public programs, or cover government expenditures.

- Tariffs can serve as bargaining tools to extract concessions from trading partners.

For example, President Trump imposed a 25% tariff on all goods imported from Mexico and Canada (10% for Canadian oil), the US’s two largest trading partners under the US-Mexico-Canada Trade Agreement (USMCA), effective February 4th 2025.

Who Pays the Price?

While tariffs may seem to penalize foreign producers by making their goods or services less competitive, the reality is that US consumers and businesses ultimately bear the cost. The added expense of tariffs gets passed down in the form of higher prices at the checkout counter and increased costs for manufacturers relying on imported inputs.

Whether it’s Colombian coffee or foreign apples, tariffs make imported goods more expensive for US consumers. Over time, they act as a hidden tax on everyday products, from groceries like avocados and beer to essential goods like appliances, medical devices, and cutting-edge technologies used in electric vehicles (EVs) and artificial intelligence (AI). The economic impact can be significant: tariffs exacerbate supply shortages if domestic production cannot meet demand, disrupt industries, and inflate costs for both businesses and households.

What Tariffs on Mexico and Canada Mean for USMCA

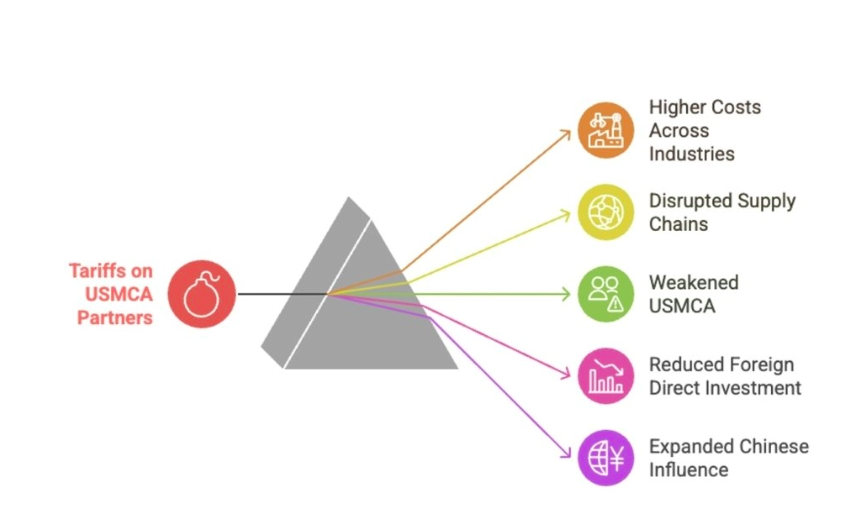

Imposing tariffs on USMCA partners would have far-reaching consequences, undermining decades of economic collaboration and integration. Here’s how:

1. Higher Costs Across Industries: Tariffs on Mexican auto parts, Canadian oil or raw materials like steel and aluminum drive up production costs in industries like US automotive or construction, reduce US competitiveness vis-à-vis the European Union or China. Higher production expenses could lead to job losses, particularly in manufacturing.

2. Disrupted Supply Chains: North America’s deeply integrated supply chains, built under USMCA and valued around $2T annually, are critical for producing essential goods such as medical devices, EV batteries, and personal protective equipment (PPE). Tariffs would weaken this regional collaboration, hinder the region’s ability to compete and innovate in high-tech industries, and invite retaliatory measures from Mexico and Canada, which together accounted for 30% of US exports in 2024.

3. Threats to USMCA’s Credibility: Tariffs would shatter trust in USMCA, making future cooperation more difficult not just on trade, but on broader issues like immigration and security. They would discourage investment in key growth sectors like AI, EVs, and advanced manufacturing, slowing innovation and economic development. Ultimately, tariffs risk jeopardizing the successful extension of USMCA in 2026.

Who Wins From Tariffs?

The clear winners from US tariffs are neither American consumers nor producers. Instead, geopolitical rivals like China and Russia stand to benefit the most. By weakening North American integration and competitiveness, tariffs create openings for Beijing and Moscow to expand their influence. A fragmented North American market is less attractive to foreign investors, further empowering China and Russia in global supply chains and reducing the region’s resilience in the face of global economic challenges.

The Path Forward

In just five years, USMCA has helped create jobs, expand trade, and strengthen North America’s position in the global economy. But tariffs threaten to undo these gains.

Instead of jeopardizing decades of progress, the US, Mexico, and Canada must work together to uphold the agreement’s rules-based framework. While tariffs might offer short-term political wins or leverage, they risk weakening North America’s global standing.

A strong, integrated North American market is essential to competing in a world increasingly shaped by geopolitical rivalry, supply chain competition, and technological innovation. Preserving USMCA is about more than trade—it’s about ensuring the region’s long-term economic leadership in an increasingly competitive world.

Published in Wilson Center

03-02-2025