- The imposition of tariffs on specified products would impact 4.7% of Mexican exports.

- Certain goods that were not affected by the tariffs imposed in 2018 have now been incorporated, including auto parts, household appliances, and electronic products, which are crucial to the industry in at least eleven Mexican states.

On February 10, President Donald Trump announced through a presidential proclamation the reinstatement of a 25% tariff on U.S. imports of steel and aluminum, effective March 12. The U.S. executive branch justified this measure using the provisions of Section 232 of the Trade Expansion Act of 1962, which allows for the adjustment of imports of goods that, after an investigation, are deemed to compromise national security. This measure will be applied universally, including to countries with which the United States maintains free trade agreements, such as Mexico and Canada. The details of the affected tariff classifications are outlined in the annexes of proclamations 10895 and 10896, published on February 18 in the Federal Register.

Products Affected by the Tariffs

To assess the potential impact of these tariffs on the Mexican economy, the Mexican Institute for Competitiveness (IMCO) analyzed the executive orders and their annexes. The analysis revealed that, if implemented, the impact on aluminum products exported by Mexico would far exceed that of 2018—when the U.S. first imposed tariffs on steel and aluminum under Section 232—and the expected impact that had been considered prior to the publication of the annexes. The scope of affected products would reach 4.7% of Mexico’s exports, equivalent to more than 1.5% of 2024 GDP.

Following the publication of the executive orders, analyses of the impact of these tariffs focused on Chapters 72, 73 and 76 of the Harmonized Tariff Schedule, with the first two related to iron and steel and the third to aluminum. Based on an analysis of U.S. imports, it was initially estimated that these measures would affect 1% of Mexican exports, approximately 0.3% of GDP. However, Annex 10895 (related to aluminum) includes tariff classifications from Chapters 83, 84, 85, 87, and 88, which cover a wide range of goods, including miscellaneous articles of base metals, nuclear reactors, boilers and machinery, electrical machinery and equipment, as well as parts and accessories for vehicles and aircraft. It is important to highlight that the tariffs would not apply to all goods outside Chapter 76 of the U.S. tariff schedule, but only to the aluminum content within them. In other words, the tariffs would not be levied on other materials used in the manufacture of these products.

Based on the experience of the 2018 tariffs, Proclamation 10896 would affect 167 tariff classifications for iron and steel within Chapters 72 and 73. In total, these classifications represented approximately $6.7 billion in U.S. imports from Mexico in 2024. Meanwhile, the value for Chapter 76, related to aluminum, amounted to $776 million.

However, as mentioned above, Proclamation 10895 on aluminum includes additional categories—unlike in 2018—such as auto parts, household appliances, and electronic products. This results in a drastic increase in the total value of U.S. imports from Mexico affected by these tariffs. According to data from the U.S. Census Bureau and the mentioned proclamation, the total value of Mexican exports of products containing aluminum subject to the new tariffs would exceed $22 billion.

Economic Implications of the Tariffs

This information indicates that, if enforced, the impact of these tariffs on Mexican exports would be of a completely different magnitude, as they target manufactured goods from some of Mexico’s most critical industries, such as the automotive sector. Of the 123 tariff classifications included in this proclamation, 68 correspond to products manufactured within that industry, including air conditioning systems, vehicle covers, and other essential components for manufacturing and assembly.

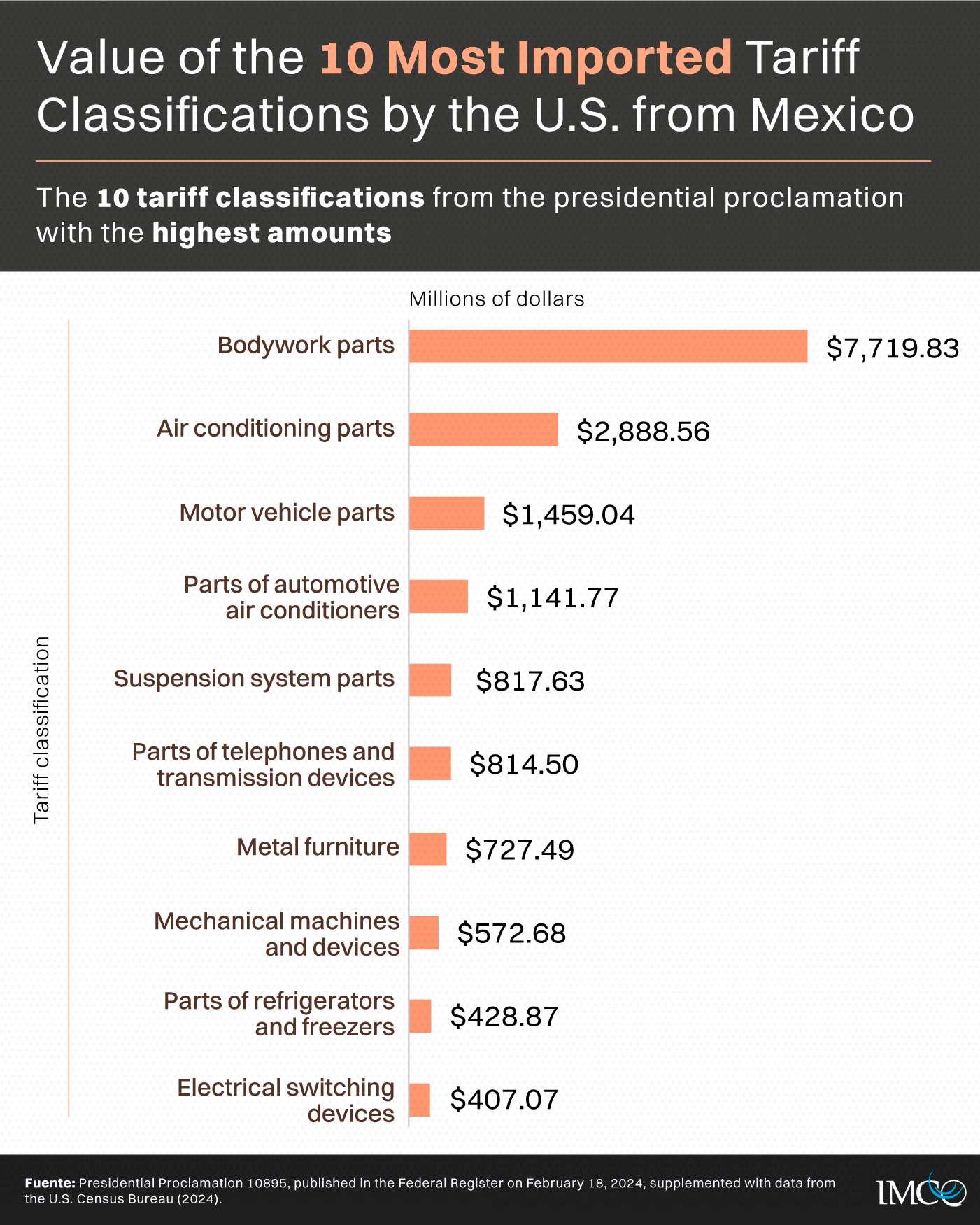

These 68 classifications alone exceeded $20 billion in 2024, representing 3.91% of Mexico’s total exports to the United States. Specifically, classification 8708295160, which includes parts and accessories for vehicle, tractor, and truck bodies, accounted for $7.719 billion in U.S. imports from Mexico in 2024.

Out of the 123 affected tariff classifications, 26 registered imports exceeding $100 million in 2024, but only three of them belong to Chapter 76, with a combined value of $667 million. The rest, amounting to over $20 billion, fall under Chapters 83, 84, 85, and 87. This shows that the aluminum tariffs announced by President Trump also impact a significant portion of the auto parts and vehicle manufacturing supply chain.

Implications for Industrial Sectors and States

If these tariffs take effect on March 12, the inclusion of additional tariff classifications would result in a more severe impact on the Mexican economy than initially anticipated. The inclusion of vehicle parts and accessories in these measures directly affects the automotive sector, one of the country’s main exporting industries.

The manufacturing sector accounted for approximately 44% of Mexico’s total exports, with the automotive industry representing 36% of all exports in 2023. In 11 Mexican states—Aguascalientes, Coahuila, Durango, Guanajuato, Morelos, Nuevo León, Puebla, Querétaro, San Luis Potosí, Tamaulipas, and Zacatecas—automotive parts and accessories are among the top three exports to the United States.

The tariff threat continues to escalate, as President Donald Trump has not only announced tariffs on aluminum and steel but has also introduced new measures affecting strategic sectors. These provisions are in addition to the tariffs announced on February 19, which impact imports of automobiles, pharmaceuticals, and semiconductors, set to be implemented on April 2.

Given these circumstances, IMCO proposes the following measures:

- Fully comply with the spirit and letter of the USMCA from the Mexican side.

- Mobilize Mexico’s allies in the U.S. Congress, state capitals, agricultural and industrial chambers, academia, research centers, and other relevant stakeholders.

- Promote bilateral dialogue with the White House, the Department of Commerce, and the Office of the U.S. Trade Representative.

- Align the Mexican government’s strategies with those of the Canadian government.

- Prepare a list of reciprocal measures in case the tariffs take effect and, if necessary, facilitate access to alternative suppliers.

- Strengthen industrial policy to mitigate the economic impact and prevent adverse consequences for the country’s development.

IMCO is a nonpartisan, nonprofit research center dedicated to enriching public decision-making with evidence to advance a fair and inclusive Mexico.

For interviews, please contact:

Paola Gurrola | prensa@imco.org.mx | Mobile. 55 4785 4940